Hi, I'm Candace

Welcome to NewWay Accounting! Explore our resources for small businesses and entrepreneurs to help you maximize your profit and amplify your tax savings!

free download

GRAB YOUR COPY!

The Ultimate Accounting Checklist for Entrepreneurs

TOP PICKS

BUSINESS TIPS

TAX DEDUCTIONS

TAX REFORM

QUARTERLY TAXES

SAVINGS & RETIREMENT

January 30, 2023

The Earned Income Tax Credit (EITC) is one of the most significant tax credits available to taxpayers. However, it is also one of the most complicated tax credits. With January 26th marking national EITC Awareness Day, it’s a great time to remind the many workers who may be missing out on this valuable tax credit.

What is the Earned Income Tax Credit?

The EITC is a significant tax credit for lower and middle income taxpayers that rewards earned income, especially for those with children. Further, it’s also a refundable tax credit, which means that it not only can be subtracted from taxes owed, but can be refunded to the taxpayer if taxes are not owed.

How Much is the Earned Income Credit?

The EITC can be worth as much as $6,935 for the 2022 tax year and $7,430 for the 2023 tax year. However, the credit amount varies significantly depending on tax filing status, number of qualifying children, and income earned.

Do You Qualify?

1. You must first have taxable “earned income”. This includes wages, tips, self-employment income, union strike benefits, and long-term disability benefits. It does not include interest/dividends, retirement income, social security, unemployment benefits, alimony, and child support.

2. You (and your spouse and qualifying child if applicable) must have valid social security numbers.

3. You have qualified children, OR:

- You (and your spouse if you file a joint return) cannot be claimed as a dependent or qualifying child on anyone else’s return, AND

- You (or your spouse if you file a joint return) are between 25 and 65 years old at the end of the tax year.

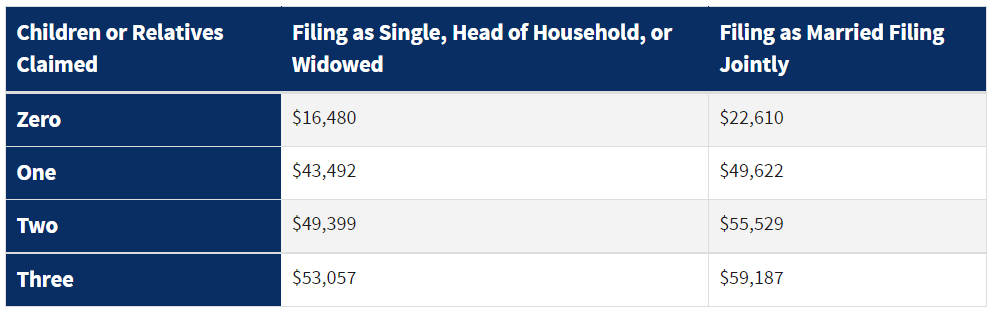

4. Your income falls within the eligible income range (please refer to the table below).

5. Your tax year investment income is less than $10,300 in 2022 or less than $11,000 in 2023.

6. You must have lived in the U.S. for more than half of the year.

Do You Have A Qualifying Child?

Qualified children must meet each of the eligibility tests:

Relationship Test:

- Your son, daughter, adopted child, stepchild, foster child or a descendant of any of them such as your grandchild

- Brother, sister, half brother, half sister, step brother, step sister or a descendant of any of them such as a niece or nephew

Age Test:

- At the end of the year the child was 18 years old or younger, or the child was 23 years old or younger and was a full-time student

- At the end of the filing year the child was any age and permanently and totally disabled

Residency Test:

- Child must live with you in the United States for more than half of the year

2022 Income Limits & Credit Amounts

For tax year 2022, your earned income and Adjusted Gross Income (AGI) must each be less than:

The EITC maximum credit amounts for 2022 are:

- No qualifying children: $560

- 1 qualifying child: $3,733

- 2 qualifying children: $6,164

- 3 or more qualifying children: $6,935

Examples

- You are 26 years old, single, have no children, and cannot be claimed as a dependent on another tax return. You are in graduate school full time and you earn $12,000 in wages from a part-time retail job. You are eligible for the EITC and would qualify for up to a $560 tax credit.

- You are 32 years old, married, and have a daughter. Your spouse is 30 years old and your daughter is 2 years old. Your daughter lives with you full time and your spouse does not work and is a full-time caregiver to your daughter. You work full-time as a landscaper making a salary of $42,000. You are eligible for the EITC and would qualify for up to a $3,733 tax credit.

- You are 50 years old, married, and have 3 children. Your children are 22 years old, 19 years old, and 16 years old. Your 22 year old is a full-time student, however your 19 year old works full-time. You and your spouse both work full-time and bring in a total of $58,000. Even though you have 3 children, your 19 year old does not qualify as a Qualifying Child because he is over the age of 18 and is not a full-time student. The earned income limit with two qualifying children is $55,529, therefore you are not eligible for the EITC.

Candace is the founder of NewWay Accounting and is a CPA who specializes in working with fellow entrepreneurs. She strives to take the fear and anxiety out of taxes and help empower small business owners to feel more confident and in control of their finances.

Leave a Reply Cancel reply

Get on the list

Sign up to get tax and bookkeeping hacks for entrepreneurs delivered straight to your inbox twice a month!

Thank you!

Get ready to feel more confident and in control of your business finances!